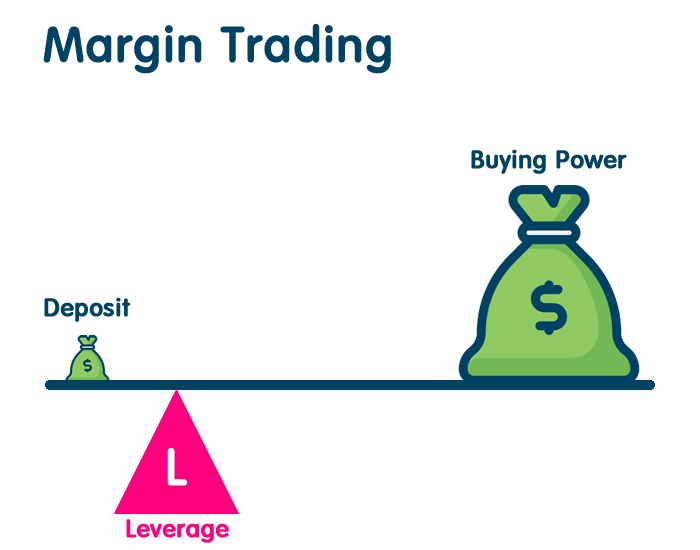

Margin trading is often seen as the risky route to go when investing in the stock market, but it doesn’t have to be that way. Not only can you make larger trades with margin trading, but it also gives you more flexibility in when you can sell your investments and how many shares you can buy per trade. With these tips on how to margin trade smartly, you can increase your profits while reducing the risk of losing money on any individual investment.

Table of Contents

1. Understand Margin Levels

Margin buying means borrowing money from your broker, which will increase your buying power and allow you to purchase more stocks. However, there are limits on how much of a particular stock you can buy using margin. According to the experts at SoFi Invest, “The two most common margin levels are 50% and 65%. Once you hit a certain price threshold, your account automatically increases to either 50% or 65% of its initial value.”

2. Keep Your Stop Losses Tight

When trading on margin, most brokers require a predetermined amount of cash in your account to cover losses, which is called the initial margin or maintenance margin. If you lose more than that amount, you can be forced to deposit more money into your account.

3. Don’t Trade On Margin With a Large Portfolio

If you’re buying stocks on margin and your portfolio is worth $200,000 or more, you could see a significant drop in value before recovering. If that happens, you may not have enough cash on hand to meet your margin call.

4. Always use mental stops

I’ve heard several horror stories of traders executing mentally on stops, so I won’t go into detail. Mental stops are a way to stop yourself from acting on emotion. You can find the information available online about stop losses and mental stops.

5. Never Chase Stocks

Chasing stocks is usually a recipe for losing money. Chasing stocks refers to buying a stock because it has risen in price over a period of time, and you feel as though it will continue to go up. When you buy into a company based on its past performance rather than what it has going on now, you are most likely buying at a high price.

6. Only Invest When Markets Are Calm

Buying on margin is a risky financial move, and you should only take that step when stock markets are calm. In other words, don’t buy stocks on margin in October during market crashes or in January during strong bull runs. Instead, wait before investing any money you might not be able to afford to lose.

7. Have an Exit Strategy Before You Invest

One of the most important aspects of investing is understanding how much money you’re willing to lose on a particular investment. Without an exit strategy, it can be difficult to know when it’s time to cut your losses and walk away from a bad investment.

Hope that now you find margin trading a little easier to understand. To sum it up, this method is a great way to trade with greater leverage and minimize your equity, but it does come with additional risks.