To shed light on the pulse of millions of Indian Mutual Fund Investors, ETMONEY has unveiled its first-ever India Investment Report based on insights curated from investors with over Rs. 100 Cr in SIPs each month spanning over 15,000 pincodes. Having enabled over 11 million Mutual fund investment transactions that empowered Indians to invest in commission-free direct plans on their own, this report offers a rare insight into how ETMONEY has been empowering the wider Indian population.

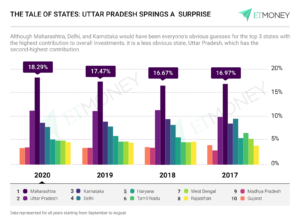

Maharashtra leads the list of states with the highest contribution by investment value, the second spot is taken by Uttar Pradesh. The presence of a not-so-obvious state in the top 3 states shows how investing in Mutual Funds is claiming wider acceptance among Indian investors. The report also presents surprising facts, such as increasing incomes not translating into higher investments to elements that fuel better returns and investor demographics across age and gender.

Delhi, Mumbai and Bengaluru emerged as the top 3 cities in terms of investment value, while cities such as Patna, Jaipur and Lucknow were surprising entrants in the top 10 cities. The rise in lesser-known cities with respect to investment contribution points at ETMONEY’s nation-wide success in making investing accessible for every Indian.

ETMONEY’s simplified approach to investing is also empowering the younger generation to take control of their finances. The ETMONEY Investment Report highlights that investors under the age of 36 are steadily increasing and their value share is also climbing up. This busts that the millennials are not considerate of their financial lives and like to spend all their income.

A notable positive presented by the report has been #RisingWomenPower. As the percentage of working women has been rising across the country, these empowered and self-driven women have been trusting ETMONEY with their hard-earned savings to invest in their family’s financial well-being in the long-term.

A very interesting observation made by the report is that increasing income is not translating into increasing investments. This indicates that as people start to earn more they spend that money to upgrade their lifestyle and increase discretionary spending rather than investing it.

The ETMONEY India Investment Report 2020 also highlights the importance of patience in investing. The allocation of top 25% investors revealed a disportionately higher allocation to ELSS Funds when compared to those in the bottom 25%. The 3-year lock-in of ELSS Funds is ensuring investors are forced to give their investments time and that is helping them earn good returns.

Speaking on the launch of the report, ETMONEY Founder-CEO Mukesh Kalra said “ETMONEY was launched with the simple yet disruptive vision of simplifying the financial journey of new-age Indians by making them feel more confident & empowered about their financial lives. The India Investment Report 2020 is testimony that our efforts to reimagine & simplify the ‘money problems’ with tech-led wealth management solutions has empowered millions of Indian investors. This unprecedented feat has been made possible by the constant love and feedback of our loyal users, and our team that has been combining the power of technology to design India-first solutions that truly make a difference in the lives of Indian investors.”

Access the complete copy of ETMONEY’s India Investment Report ‘20: ETMONEY Investment Report 2020

About ETMONEY

ETMONEY is India’s largest app for financial services that is simplifying the financial journey of new-age Indians. Consumers use ETMONEY to invest in zero-commission Direct mutual funds for Free, protect their families with unique Insurance solutions & use ETMONEY Credit Card to take instant loans at low-cost. Growing at 350% yearly, combined with multiple innovative solutions, it has grown to 7Mn users from more than 1300+ Indian cities and is driving more than $500Mn of non-payment annual transaction volume on its platform