The idea of integrating top payment gateways is more than valuable for organisations that want to deliver an exceptional user experience.

However, not all payment gateways work accurately in all geographical areas. Different payment gateways make sure that customers have access to quick transaction processing and a better checkout experience.

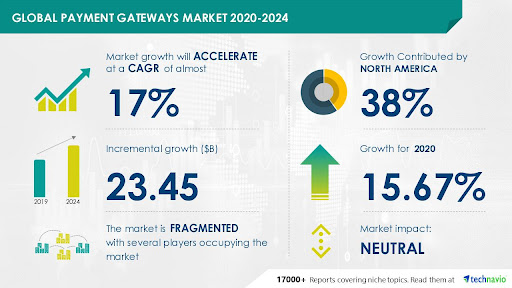

Here you can see the global payment gateways market statistics from 2020 to 2024.

Merchants can receive and validate online payments by integrating multiple payment gateways. More than one payment gateway boosts the customers’ reliability, keeping them returning to business. It also enhances the probability of successful transactions.

In this post, we will explore the reasons why payment gateway integration is beneficial to businesses. So, let’s get going.

Table of Contents

Perks of Payment Gateway Integration

|1. Streamline the payment process

The benefit of integrating a payment gateway API is it simplifies the entire payment process. Starting from the request to validation to receipt and affirmation, the complete process gets simplified.

With a cardless approach, customer payments can also be performed with great ease.

Cardless payments let organisations receive payments directly from their customer’s bank accounts, mitigating the chances of late payments and saving valuable time. Moreover, organisations get paid faster by enabling cardless payments on their online invoices.

|2. Better customer experience

Integrating payment gateways provide extra features to enhance the real-time customer experience. Generally, customers add their items directly to a shopping cart or their favourites.

Customers can effortlessly set up their profile and store their payment details safely, so their transactions can be quick with a single tap.

For merchants, payment gateways usually enable full control and prevent any issues if they arise. However, it is quite costly and time-consuming to integrate payment gateways into your system.

|3. Customisation option

Another advantage of payment gateway APIs is that they enable businesses to be creative by customising and personalising their online store checkout experience.

There are tons of organisations that stick to the basic API payment integration, some discuss their concepts with a developer who can customise the checkout page and address the merchant’s vision.

For a brand looking for consistent branding maintenance on their site starting from browsing to checkout, it could be an essential benefit.

|4. Secure checkout experience

With top payment gateways, every payment transaction is highly encrypted to ensure data security.

It will aid your organisation address GDPR and industry standards like the PCI DSS adherence (Payment Card Industry Data Security Standard). Safe transactions safeguard the customer and retailer from possible fraudulent activities.

Customers will generally use highly secure payment options, so increasing their reliability to make purchases with your business needs to be a priority.

|5. Support different types of transactions

Some payment gateway APIs support an extensive range of transaction types, and not only ordinary credit/debit card payments.

As more and more individuals are choosing different payment approaches, it can help extend your client base and comfort your customers, who will admire their favoured payment methods being accessible.

|6. Store transactions offline

Another functionality which is accessible with tons of payment APIs (not all) is the capability to store transactions offline to get processed when the internet reconnects.

|7. Keep your existing system

A well-developed payment processor integrates smoothly with your platform. There is no need to change your model to adjust to the payment system — contrary, the processor fits you.

Advanced payment processing systems are designed focusing on user-friendliness and adaptability, so businesses can merge them into their platform effortlessly.

|8. Expand the platform value

By embracing a convenient payment system, you are automatically boosting your platform value. The comfort, credibility and safety of a powerful payment gateway processing system are worthwhile to your customers.

Having a payment gateway integrated directly into your platform eliminates obstacles to entry for customers and enhances their experience. Simply put, you are expanding the probability that customers purchase from your store.

|9. Boost the number of international sales

Doing business with international clientele enhances a business’s bottom line, and improves its location-based coverage.

Due to the lack of preferred payment options in-store, customers do not prefer to buy from it. So, offering different currency options on your store’s checkout page can work in your favour.

With an e-store, organisations can sell to anyone, no matter at what location they are. However, the currency difference can pose a crucial threat. A single payment gateway is not sufficient to process online payments from different states.

So opt for top payment gateways to receive payments from international customers without any hurdles.

In a Nutshell

Automation has turned out to be a huge timesaver. As it increases, it can also save you a lot of funds and let your consumers pay more flawlessly than ever before.

If you are executing a Software as a Service (SaaS) product, payment gateway integration is the best step. It helps to free up more time, receiving more revenue and outshining in the ever-evolving competition.

Also Read: How Much Does Pest Control Cost.