The average accounting team spends eight days each month preparing the month-end closing. Unfortunately, the following applies: After the monthly closing is before the monthly closing. And the monthly closing is neither exciting nor value-adding.

The time that the finance team spends collecting receipts and accruing open items is missing elsewhere: for example, advising management, further developing the company’s internal financial policy, evaluating new and better tools, etc.

The less time spent on the monthly closing, the better. We will therefore explain to you which process you can use to complete your month-end closing quickly, share a suitable Excel checklist and break down the individual tasks during the month-end closing for you.

Table of Contents

What is a monthly financial statement – and who is it mandatory for?

The monthly closing consists of…

- the collection of financial accounting data,

- their review

- and the comparison of records.

The aim is to close the accounting period at the end of the month, gain an overview of the company’s expenses and income and send current reports to the management, on which strategic decisions can be based.

In principle, the preparation of monthly financial statements is voluntary, in contrast to annual financial statements. But there are a few exceptions:

Public companies

Listed companies often have a legal or contractual obligation to prepare interim reports. These are – just like the monthly financial statements – an accounting instrument during the year. However, they primarily serve to provide transparency for investors and the market and are typically created semi-annually or quarterly. Nevertheless, many corporations prepare monthly financial statements in order to be able to work and plan consistently with current figures internally.

New business founders

In the first two years of setting up a business, companies and self-employed persons’ subject to VAT must submit their advance VAT return to the accounting department on a monthly basis. Here too, all income and expenses must be recorded at the end of the month and submitted by the 10th of the following month. Strictly speaking, there is no obligation to submit monthly financial statements, but the obligation to submit a monthly advance VAT return makes this necessary.

Tasks and benefits of month-end closing

Finance teams are notoriously chronically short on time. And monthly financial statements aren’t even mandatory for many companies. So why do so many companies still undertake this task every month?

Despite all the effort, monthly financial statements are worth it:

- They provide timely information about the financial situation of a company.

- They ensure that receipts for audits and company audits are available in an orderly manner at all times.

- You minimize the risk of errors in quarterly and annual financial statements.

- You prepare the annual financial statements and reduce the workload at the end of the financial year.

Thanks to monthly financial statements, you always know where your money comes from and where it’s going – so you get a clear picture of your cash flow. The monthly closing reveals impending budget overruns and helps to optimize the company’s expenses.

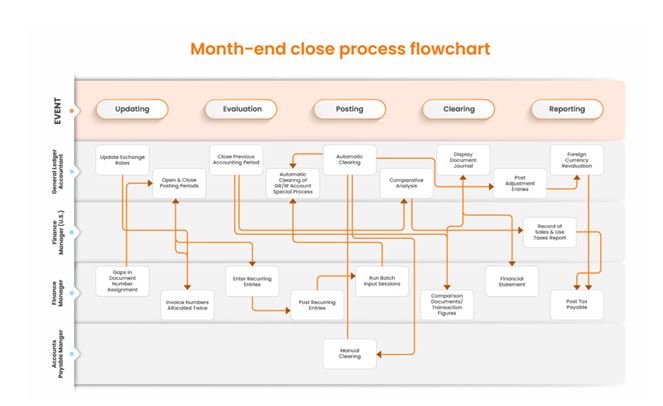

The month-end closing process in 5 steps

There is no one perfect month-end checklist because every company is different. Some sell physical products and need to keep track of inventory levels. Others are service-oriented or have to worry about particularly large petty cash and office costs.

Nevertheless, the month-end closing process for start-ups and SMEs can generally be divided into five elementary steps.

- Accounts receivable

- Accounts Payable

- Account reconciliation

- Review of assets and liabilities

- Reporting

Step 1: Accounts receivable (trade receivables)

Start by recording all income received during the month – whether it is cash, bills, loans, or other income. This also includes checking whether your customers have paid outstanding invoices according to the payment deadline and transferred the correct amounts.

For clarity, every transaction should be logged.

Step 2: Accounts Payable (Trade Payables)

Depending on how disciplined you are about collecting receipts throughout the month, this step can be either a breeze or the most time-consuming on the list. For accounts payable, match all outgoing payments to the appropriate expense receipt or invoice.

Important: Also check whether all outstanding liabilities have been paid. It is best to communicate to the employees in your company a deadline by which freelancer invoices, expense reports and other receipts must be submitted in order to be paid on a monthly basis.

Step 3: Account Reconciliation

During this step of the month-end closing, each transaction is compared and verified with that of the corresponding account movement. In the end, the entries must correspond to the balance in the corresponding accounting account. When it comes to discrepancies, the devil is often in the details: double bookings, bookings in the wrong accounting account or several small incorrect bookings that add up.

This step also includes the reconciliation of the cash balances (i.e. the comparison of the cash account in the accounting with the cash balance in the cash register), the reconciliation of the social security accounts and the VAT accounts.

Step 4: Review assets and liabilities

Now identify and document all of your current fixed assets and liquid assets and note whether there have been any new purchases or transactions related to these assets. Document all loans taken out for the business and their repayment history.

Step 5: Reporting

Now it’s time to create the monthly final reports, e.g. the monthly balance sheet, the profit and loss statement and the income and surplus statement. Receivables and liabilities must have a net value of zero as an account balance. Otherwise, something went wrong in the previous steps.

The financial reports created here are an incredibly important basis for decision-making for the company. Therefore, it is often one of the tasks of the finance team not only to determine the data, but also to prepare and visualize it in such a way that busy CEOs can get an overview in just a few minutes.

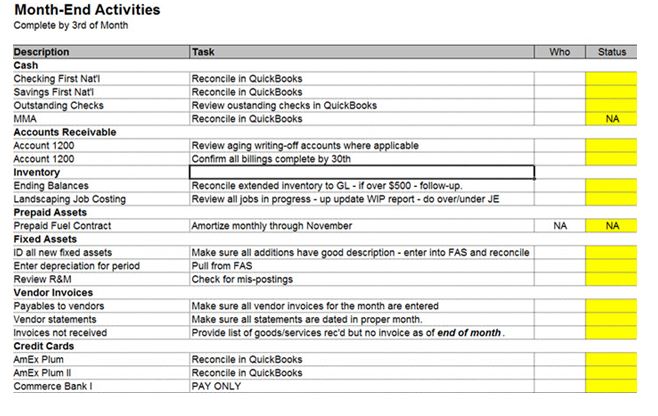

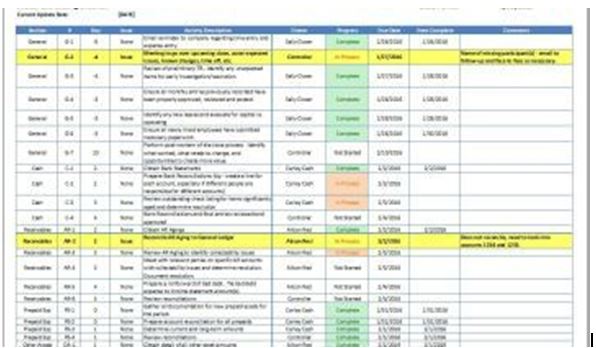

Your month-end closing checklist for Excel and Google Sheets

With our month-end closing checklist for Excel and Google Sheets, you can approach your month-end closing in a structured manner – with automated, standardized processes step by step.

The preparation of monthly financial statements

Monthly financial statements are like cleaning your house. If you wipe the surfaces after cooking and peel off the glass surfaces after showering, you will have a lot less work doing weekly cleaning. Likewise, finance teams who directly digitize and carefully assign receipts in everyday life benefit from less stress during the month-end closing.

A sticking point when preparing monthly financial statements is receipts. Chasing these costs time and nerves. And if credit card payments are not allocated correctly and approvals cannot be traced, the monthly closing quickly becomes a nightmare.

This is exactly where expense management software solutions come into play. In combination with common accounting software like Acterys, this is worth its weight in gold! Please note, Acterys is a powerful tool that also offers Netsuite Power BI integration and Excel add-ins.

Automate expense management for easier month-end closing

What if you could transfer responsibility for document entry to your employees instead of burdening the finance department with it? The easier it is for employees to record their receipts from anywhere, the less likely they are to be lost. And if you forget to upload the receipt for a payment, the person concerned is automatically reminded.

Automated payment reconciliation, employee debit cards, real-time data and traceable approvals – all of this can be achieved with Spenderk’s expense management software. According to our customers, this makes month-end closing four days faster.

Of course, creating the monthly financial statements is a Sisyphean task and cannot be completed without manual effort. But whoever gets the document capture under control has already half won the battle.