Stock Market is like Riding on a Roller Costar Ride. Where you will experience many up’s And Down During Your Journey. If You Have Full Confidence and Complete Knowledge About This Market then You will go to Enjoy Your Ride otherwise it is very Risky for First Time Riders and It Makes People not Visit here again.

Before Entering this Market as a Beginner you should grab some Information or you would Have to Understand some Basic Concepts of How this Market work. Or else without any Knowledge, you will end up Losing Your Money and will gain nothing.

What Is P/ E Ratio?

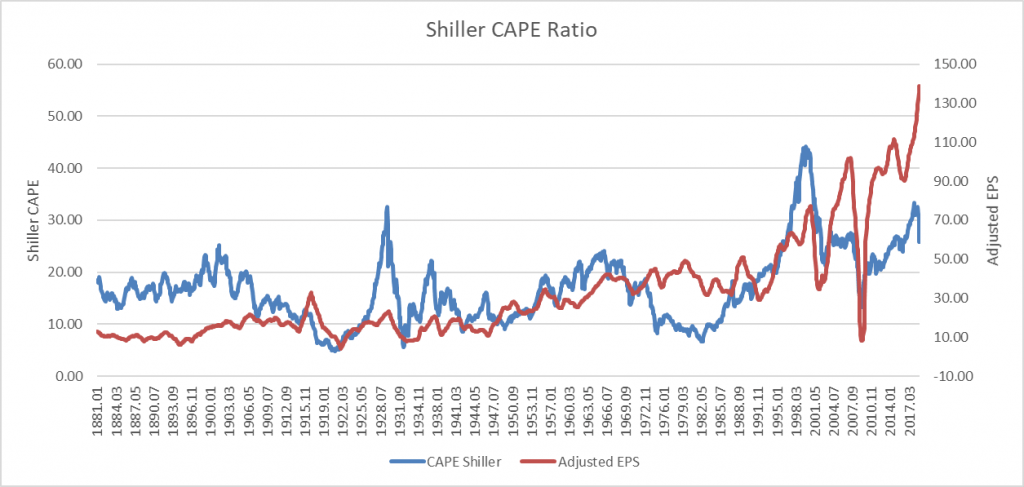

P/E ratio is a Price Earning Ratio which is used by All the Investors in Stock Market. This Ratio is used to Analysis Stock value In Market. Means it makes you understand How Expensive the Stock Is and Also Make You Know about the stock Price of the Company and Its Earning.

It is calculated by dividing the Stock Price with Earning per Share (EPS)

P/E Ratio= Stock Price / Earning Per Share

How P/E Ratio Analysis Stock?

Price Earnings Ratio of a Stock determines the Price of Stock who has High Value in Market. Generally These Stocks Are in High demand In Market by the Investors. Every Investor is Investing There Money in the Company who Have Great Turn Over and Who’s Shares Have High value in Market. This Companies Have High Performance ratio that is Why There Stock Value is high.

People are investing in these shares with the expectation that High performing stocks will provide them More Earning and Profit. But Mind my Words higher the Value of Stock will have More Risk in Market as if anytime they failed to perform in Market as Expected by the Investors due to certain reason then lot of Investors Will bear Heavy Loss Of their Money.

Stock Market Is Uncertain it will never Work according To Your Expectations. That is Why This Market is known As Risky. It performs a game Of Gambling where You win or lose according to your Luck and Charm.

While Focusing More on High performing Stocks People Ignore lower Price Earning Ratio Stocks Which is Opposite of Higher Price Earning Ratio. These Lower P/ E ratio is of the Company which has Lower Performing stocks and Ha e Lower risk in market. But sometime what you think doesn’t happen and what you have Not Expected, provide Benefit to you. The same goes with Stock Marketing Shares. Here you invest In High performing Stocks but Lower Stock Make Unbelievable rise in market.

Hope You have Understood from the Above mention Points that Higher P/E Ratio help in Stock Analysis but you can Not fully depend on it. Most of the Investors Use this Tool to Analysis about the Stocks in which they are investing. They carry there trading Business on behalf of this tool.

But you should also make sure to Grab Full knowledge about Stock and Its Tools before investing your money in it.

About The Author

Gaurav Heera is a stock market analyst & professional trader. He’s also known as best stock market trainer in India and sharing his knowledge & expertise through his two best known courses named Stock market course in Delhi & Technical Analysis Course in Delhi.