When it comes to qualifying for a personal loan, there are a few things you’ll want to keep in mind. First, you’ll need to meet the lender’s credit requirements. Typically, you’ll need a credit score of at least 600 to qualify for a personal loan. You’ll also need to have a stable job and income.

Lenders want to be sure that you’ll be able to repay your loan, so they’ll review your income and debt-to-income ratio. If you have a lot of debt, you may not be able to qualify for a personal loan. Finally, you’ll need to be at least 18 years old. Lenders will also want to see that you have a checking account and a valid driver’s license.

If you meet these requirements, you’ll likely be able to qualify for a personal loan. Keep in mind that the interest rates and terms will vary depending on your credit score and income.

If you’re looking for a personal loan, be sure to shop around and compare rates. You may be able to find a lower interest rate by shopping around. And, if you have a good credit score, you may be able to qualify for a lower interest rate.

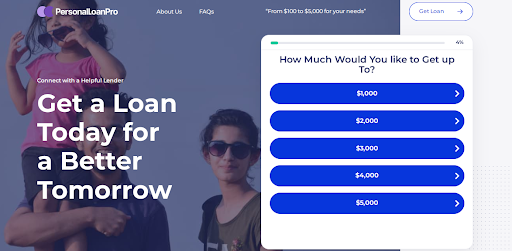

If you’re looking for a personal loan, be sure to check out the PersonalLoanPro website. Personal Loan Pro is a marketplace for personal loans that connects you with lenders who can offer you a loan. You can compare interest rates and terms to ensure you get the best possible deal.

Table of Contents

Do I Need A High Credit Score To Apply For A Personal Loan?

You may be wondering if you need a high credit score to apply for a personal loan. The answer is no – you can still get a loan with a lower credit score. However, the interest rate on a personal loan will be higher if your credit score is lower.

If you’re looking to take out a personal loan, it’s important to know what your credit score is. Your credit score is a measure of your creditworthiness and is used by lenders to determine your interest rate.

A high credit score means you’re a low-risk borrower, which means you’ll likely get a lower interest rate on a loan. A low credit score, on the other hand, means you’re a high-risk borrower, which means you’ll likely pay a higher interest rate.

Even if you have a low credit score, you can still get a personal loan. However, the interest rate on your loan will be higher than if you had a high credit score. It’s important to shop around and you can rely on Personal Loan Pro to find more detailed information about finding the best interest rate and to compare rates from different lenders.

If you’re looking to improve your credit score, there are a few things you can do.

- First, make sure you’re making on-time payments on all of your debts.

- You should also try to keep your credit utilization low – i.e. don’t use a lot of your available credit.

- Lastly, make sure you’re not applying for too many loans or credit cards.

If you have a low credit score, a personal loan may be a good option for you. Just be sure to shop around for the best interest rate and to compare rates from different lenders.

What Is The Difference Between A Secured And An Unsecured Personal Loan?

When it comes to taking out a personal loan, there are two main types to choose from: secured and unsecured. So, what is the difference between the two?

Secured Personal Loan

A secured personal loan is backed by collateral. This could be anything from your home to your car or savings account. If you can’t make your monthly payments, the lender can seize the asset that serves as collateral.

Unsecured Personal Loan

An unsecured personal loan doesn’t require any collateral. This means that if you can’t make your monthly payments, the lender can’t take anything from you to recoup their losses. However, unsecured loans typically come with a higher interest rate, as there is more risk for the lender.

So, which type of loan is right for you? That depends on your personal circumstances. If you have a lot of assets that you could use as collateral, a secured loan might be a good option.

However, if you don’t have any assets or you’re worried about risking them, an unsecured loan might be a better choice. Speak to a financial advisor to figure out which type of loan is right for you.

How To Compare And Choose Suitable Personal Loans?

When you need money and you do not want to borrow it from friends or family, you may decide to take out a personal loan. This type of loan is unsecured, which means you don’t need to put up any collateral. Personal loans are offered by a variety of lenders, including banks, credit unions, and online lenders.

Before you take out a personal loan, you’ll want to compare your options. You can use the Personal Loan Pro website to compare and choose the lender and loan that are best for you. Here are some things to consider when comparing personal loans:

Interest Rates

Look for a personal loan with a low-interest rate. Some lenders offer a fixed interest rate, while others offer a variable interest rate.

Fees

Some lenders charge origination fees, while others charge prepayment penalties. Be sure to ask about any fees associated with the loan before you sign up.

Term

The term of a personal loan is the amount of time you have to repay the loan. Most personal loans have a term of one to five years.

Amount

The amount you can borrow with a personal loan varies from lender to lender. You may be able to borrow up to $100,000 or more with a personal loan.

The best way to find the right personal loan for you is to compare rates, fees, and terms from a variety of lenders. Use a personal loan calculator to see how much your monthly payments will be. When you’re ready to take out a personal loan, be sure to compare your options and choose the lender and loan that are best for you.

What Should You Do Before Getting A Personal Loan?

For many people, a personal loan is the best way to get the money they need for a major purchase or other expenses. Before you apply for a personal loan, there are some things you should do to make sure you are ready.

1. Make A Budget And Track Your Expenses

When you know how much money you have coming in and going out, you can get a better idea of how much you can afford to borrow. Make sure you include your regular expenses as well as any one-time costs associated with the loan.

2. Check Your Credit Score

Your credit score is one of the factors lenders look at when deciding whether to approve your loan. If your score is low, you may need to improve it before applying.

3. Compare Interest Rates

Different lenders offer different interest rates, so it’s important to compare rates before you choose a loan.

4. Read The Terms And Conditions

Be sure to read the terms and conditions of any loan before you sign up. This includes the interest rate, the amount of the loan, and the repayment schedule.

5. Make Sure You Can Afford The Repayments.

It’s important to make sure you can afford the repayments on the loan before you apply. Otherwise, you may end up in debt.

If you follow these tips, you’ll be ready to get a personal loan and start enjoying the benefits of extra cash.

Conclusion

If you’re looking to buy a car or home, you may want to consider a personal loan. A personal loan can provide you with the money you need to buy a car or home. And, since the interest rates are typically lower than car or mortgage loans, you may be able to save money on your purchase. To qualify, you need to meet the lender’s requirements such as good credit.