Bridging loans are short term loans to facilitate and fulfil the short term needs of individuals. When waiting to secure permanent financing and meet its requirements or to remove their existing obligations, a person or company avail of the service of a bridge loan. Bridging loan providers allows individuals and companies to encounter current obligations by providing instant cash flow.

If the question arises in your mind that how can you get emergency cash advance then here is the solution to your problem. By visiting the site of USBadCreditLoans anyone can get a loan for needs.

Table of Contents

Bridging loan Characteristics

Characteristics can be explained as there are short-term loans with a duration of up to one year, have an adequate interest rate, and are typically backed by a particular form of security, just like real estate and inventory.

loans fill the gap during times when there is a need for finance but not yet accessible. Individuals and businesses both are using bridging loans. Lenders are customising such loans for multiple situations.

How bridging loans works:

You have already purchased a long term financing facility, but right now, you are in need to fulfil your short-term financial obligations. For this purpose, you are looking for someone who can provide you with a suitable loan package that satisfies your condition and provides you with an adequate financing facility.

Bridging loan providers could help landlords purchase a new home while waiting for the sale of their current homes. Borrowers use the equity in their existing home for the down payment and purchase their new home. Such a situation happens when they wait for their current home to sell.

Example

For example, you are living in an old house, and you want to buy a new one. But your financial condition does not allow you to meet the financial gap between the sale of the existing house and buying a new one. The bridging loan provider will work as a “bridge” and provide you with a line of credit to cover the gap between purchasing a new property and selling the old one.

Some home loans usually come with high-interest rates but bridging loans are at an adequate interest rate helping a person or company to avail the facility and fulfil their financial obligations.

How do Bridge Loans Work for Businesses?

For businessmen who are looking for a long term finance facility and have to meet their short term expenses and obligations, bridge loans turn out to be the best option for them. For example, suppose an organisation is doing a round of equity financing predictable to terminate within six months. They can use bridging loans in order to provide working capital to cover their rent, salaries and utilities along with inventory costs and further expenses until a round of funds goes through.

Real Estate Industry & Bridging Loan:

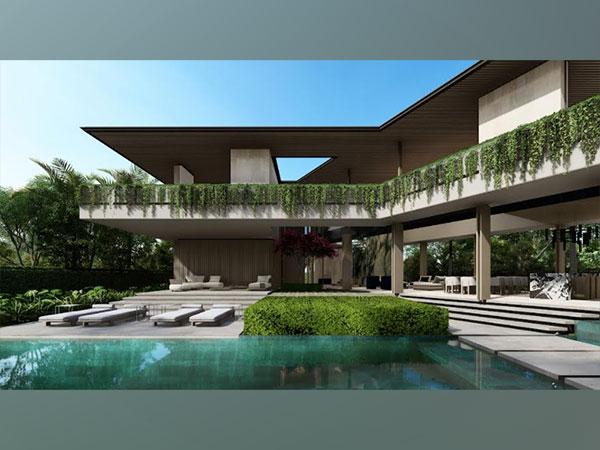

Bridging loans in the real estate Industry are established to facilitate property investors to enhance their business. If buyers have a gap between the sale of one property and the purchase of another property, they may turn to bridge loans. Usually, lenders just offer real estate bridging loans to borrowers with outstanding credit ratings and less debt to income ratio. Bridging loans provide mortgage services to two houses at the same time, giving buyers ease while they are waiting for their old house to sell. Though in some situations, lenders just offer real estate bridging loans worth eighty per cent of the joint value of two properties, which means that borrowers must have substantial home equity in the property that they are using as security against the loan.

How are Bridging loans Different?

Bridging loans typically have faster application services and approvals and, finally, a faster process of funding than other traditional loans. On the other hand, in return for convenience, bridging loans tend to have comparatively fewer registration fees and interest rates. Usually, borrowers accept such terms as they search for fast and suitable access to funds. A person or company has to pay high-interest rates due to the short term nature of loans and can plan to pay it off with less interest and long term finance swiftly. Furthermore, most bridge loan providers do not charge early repayment of penalties.

Benefits of Bridging Finance

The bridging finance option is for those slow periods when you’re struggling to keep your company afloat without any revenue. We can provide flexibility and more time so that even though it’s a low point, there’ll still be opportunities waiting just around the corner.

The bridging finance option is ideal for when you need to cover operational costs such as wages, running items and specific organisational expenses.

4 Benefits of Bridging Finance

The capital you need is right at your fingertips. With a conventional loan, it can take weeks or months to receive the money in order for them. To make a profit off their investment and pay back partners who invested alongside them. But not with BridgeLending! We provide quick turnaround times. So that businesses have time enough just sit back while we handle all aspects of financially powering these growth periods. Without any hassle on either side.

Bridging loans are a great option if you need short term financial assistance while your property on sale or rent-to purchase agreement is being finalised. They can be used for most types of properties, from standard residential to semi-commercial and full-scale developers who want their land developed ASAP.

Bridging loans

Bridging loans are a great option for those. Who needs money quickly and doesn’t want to take on the risk of long term debt. With these types, you can make frequent small payments without having an unexpected expense come up in your life. That could cause big problems if it is not planned accordingly with budgeting. Saving enough cash beforehand so there’s always. Some sort of guarantee against loss due to unexpected circumstances happening.

There are two different ways you can handle the interest on your bridging loan. You could either serve it monthly and make sure. That all of those pesky little numbers go down. Or add them onto an advance so they’re paid back later in full when settlement happens at term’s end.

Bridging loans are a fast and easy way to get the money you need without taking too long.

This is because usually, your application will go through in just weeks, as opposed to months or even years with other forms of finance such as mortgages loan.