The Board of Max Financial Services Ltd. (MFSL) has approved a transaction which will allow Mitsui Sumitomo Insurance (MSI) to swap 20.57% of its shareholding in Max Life insurance with 21.87% stake in MFS.

MSI is a part of the world’s 7th largest MS&AD Insurance Group Holding of Japan. Max Financial Services and MSI are 73:25 joint venture partners in India’s fourth largest private Life Insurer Max Life Insurance Company.

This will enable the Company to simplify the shareholding structure in its subsidiary and have more flexibility to attract strategic investments in Max Life in the future and yet maintain its significant majority ownership.

The transaction will also provide MFS the option to purchase from MSI its balance shareholding in Max Life for cash at a price of Rs. 85 per share.

The transaction structure will involve MSI subscribing 75,458,088 shares of MFS having a par value of Rs. 2/- each at a price of Rs. 565.11 per share aggregating to 21.87% of the paid-up equity share capital of the Company on the date of allotment of the aforesaid fresh shares.

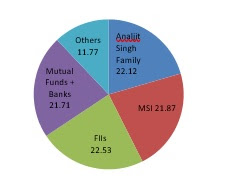

In consideration, MFS will receive 394,775,831 shares of Rs. 10/- each from MSI at a price of Rs. 108.02 per share translating into 20.57% stake of MLIC. Pursuant to this, the equity stake held by MFS in Max Life will increase to 93.10%. The transaction will lead to a change in MFS’ shareholding pattern as below:

|

|

| Existing Shareholding Pattern | New Shareholding Pattern |

MFS is listed on the National Stock Exchange and Bombay Stock Exchange. Its sole operating subsidiary Max Life is the largest non-bank owned private life insurer in India. Max Life has been at the forefront of the current buoyant phase in the Indian Life sector. For nine months ending December 31, 2019, Max Life reported Market-Consistent Embedded Value (MCEV) of Rs. 10,077 Crore; an Operating Return on EV (RoEV) of 18.4%; Value of New Business1 (VNB) at Rs. 576 Cr., growing 24% YoY and the New Business Margin2 (NBM) of 21%, 60 bps higher YoY.

Mohit Talwar, MD, Max Financial Services and Vice Chairman, Max Group,

The transaction is subject to requisite approvals and is expected to be concluded by June 2020.

About Max Financial Services

Max Financial Services Limited (MFS), a part of the leading Indian multi-business conglomerate Max Group, is the parent company of Max Life, India’s largest non-bank, private life insurance company. MFS actively manages a 72.5% stake in Max Life Insurance Company Limited, making it India’s first listed company focused exclusively on life insurance.

MFS is listed on the NSE and BSE. Besides a 28.3% holding by Analjit Singh sponsor family, some of Max Financial Services’ marquee shareholders include KKR, New York Life, Baron, Vanguard, Blackrock, Aberdeen, First Voyager, Jupiter, Dimension, East Spring and the Asset Management Companies of Nippon, HDFC, ICICI Prudential, Aditya Birla Sun Life, Mirae, BNP, DSP and Sundaram.

About Max Life

Launched in 2000, Max Life is a Joint Venture (JV) with Mitsui Sumitomo Insurance, a Japan-headquartered global insurance leader. Max Life is India’s largest non-bank private life insurer and the fourth largest private life insurance company, with gross premium income of Rs. 14,575 crore and a Claims Paid Ratio of 98.74% in FY19. It has over 4 million policies in force and has a pan-India presence through 345 branch units. Max Life Insurance offers comprehensive long-term savings, protection and retirement solutions through its high-quality agency distribution and multi-channel distribution partners. A financially stable company with a strong track record demonstrated over the last 19 years, Max Life Insurance offers superior investment expertise. Max Life Insurance has the vision ‘to be the most admired life insurance company by securing the financial future of our customers’. The company has a strong customer-centric approach focused on advice-based sales and quality service delivered through its superior human capital.

- Value of New Business at post-

overrun costs - New Business Margin at post-

overrun costs