Everybody makes mistakes sometimes, but when it comes to your budget, your mistakes have financial consequences. Watch out for the following five budget bloopers to save money and peace of mind.

Table of Contents

1. Thinking in Extremes

An all-or-nothing attitude can be dangerous for your finances. It convinces you a budget is either a complete success or a total failure, and even one spending slipup can cause disaster.

Thinking in extremes is stressful, to say the least, but it can also interfere with how you spend and save your money. You’re either spending all your money or saving all your money — there’s no in-between. This puts enormous pressure on you to follow impossible rules, and when you make a mistake, you can feel like a disappointment. Worse yet, you can give up on your budget entirely and spend even more.

A budget needs moderation to be successful, so remember to plan for fun spending in addition to the responsible duties of saving and debt repayment. Don’t be so hard on yourself if you make a mistake. Consider it a lesson and try harder next month.

2. Failing to Save Every Month

An emergency fund is a large pile of savings that can bail you out of sticky situations. By most financial advisors’ accounts, it should contain three to six months of living expenses. Saving on that big of a scale is easier when you make consistent contributions to your fund. This strategy taps into the law of compounding gains whereby even small savings will accumulate over time until they become something impressively large.

To maximize the power of compounding gains, shop around for a high-yield savings account that offers at least 4% interest. These returns will help you grow your emergency fund faster.

3. Going to One Bank for a Loan

Some unexpected expenses surpass what you have saved in your emergency fund. Extensive auto repairs, appliance breakdowns, and even a medical prescription can warrant borrowing a loan online. Borrowing from the bank you hold a checking account with might seem like the obvious choice, but you can’t know if they offer the most favorable terms until you shop around.

Each lender may offer unique rates, terms, and loan limits, and there are new options to consider beyond your usual bank. Online direct lenders, credit unions, credit access businesses, neobanks, and more — you should include a variety of lenders to increase your chances of finding something affordable in your emergency.

4. Working with Guestimates

Let’s face it—building an accurate budget is tedious. You have to go through your financial accounts and records to make a precise list of your monthly income and expenses. To save time, you might skip this step and work with rough guestimates instead.

While working with approximate numbers is better than nothing, you run the risk of under- or overestimating your spending. Thinking your collective utility bills are $500 when they’re really $750 can result in a mad scramble at the end of the month when you owe $150 more than you thought.

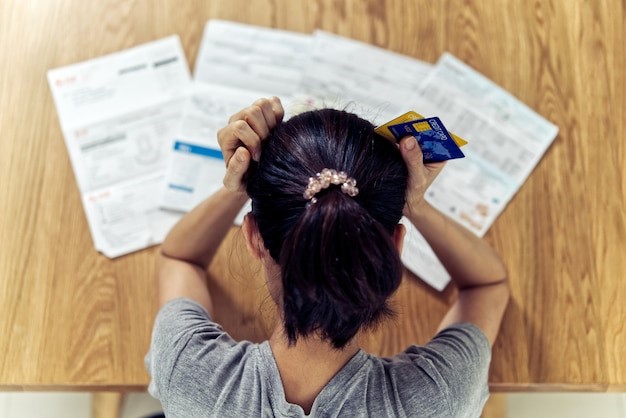

5. Spending without a Budget

The biggest blunder of them all? Spending without a budget. A budget is your spending plan. Without one, your spending may not align with your financial goals. You can easily lose track of what you’ve spent and overextend yourself. Prioritizing your bills, savings, and debt is so much easier when you make a budget. Whether it’s an old-fashioned piece of paper or a modern app, this spending plan helps you stay accountable.