Are you eager to invest your money and make more profits? If so, an MT4 PAMM account could be a fantastic solution for you! This type of trading account permits investors to pool their funds together, letting a professional trader take the reins and trade on their behalf. It is ideal for those who are unfamiliar with investing or time-constrained from personally engaging in it – so how does it work exactly?

What is a PAMM Account?

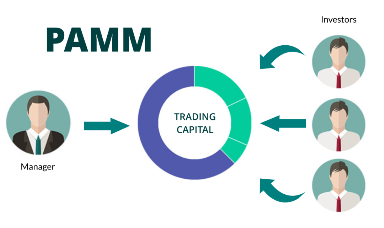

The Percentage Allocation Management Module (PAMM account) is an investment model that enables investors to combine their capital and manage it by an experienced trader. This professional will then trade on behalf of all the members in the pool, ensuring fair distribution of gains or losses along with everyone else.

PAMM accounts, available on the MetaTrader4 trading platform, are a great way for Forex brokers to attract new clients. They’re also ideal for investors who don’t have the time or experience to trade themselves and would rather leave it in the hands of a professional.

MT4 PAMM account has three members:

- The Manager is the trader (or team of traders) who manages the account and makes trades on behalf of the investors.

- The Investor allocates money to the account and allows the manager to trade on their behalf.

- Lastly, the Broker is the company that provides the platform and account where trading occurs.

PAMM accounts may be handled by an individual or a collective of traders.

All investors in a PAMM account share the combined profits (or losses) proportionally according to their deposits. For instance, if three people with separate accounts each allocate $100,000 towards one shared PAMM account, then they will all have an equal 33.3% stake and consequently be entitled to that same percentage of returns.

If the account gained $10,000 in profits from trading over the course of a month, each investor would receive 33.3% of that amount, which amounts to $3,333. However, if the account lost money during this same period, each investor would lose 33.3% of their investment as well – resulting in a $3,333 loss.

PAMM accounts can be an incredible avenue for making passive income from trading without any labor on your part. However, it is paramount that you understand the potential risks involved before investing in one.

Risks Associated with PAMM Accounts

PAMM accounts provide numerous benefits, such as the potential to make substantial returns that surpass those attainable through standard investing methods. Additionally, investors are able to reap profits without having to trade personally. Nevertheless, it is prudent to contemplate associated risks before committing any funds.

Although many investors will likely generate significant profits through their PAMM account investments, it’s important to recognize that there is risk involved. In foreign markets, this risk can be even more pronounced as political and economic conditions are often prone to rapid change without warning or notice. This means that while the potential for success exists with a PAMM account, it also carries the possibility of losses too.

Another concern to bear in mind is the threat of fraud. Sadly, there have been several instances where PAMM account managers swindled their clients by either misdirecting funds or giving false information regarding the performance of the account. For that reason, it is essential to only make investments with trustworthy and reliable individuals controlling a PAMM account.

Despite the inherent risks that come with PAMM accounts, they remain a reliable method for investors to increase their profits. Yet one must keep in mind that all investments are accompanied by some measure of risk. To make sure you’re making an informed decision for yourself and your specific needs/goals, it’s essential to do due diligence on the manager prior to investing in any PAMM account. Through careful research and understanding of all potential outcomes, you will be able to confidently choose what is right for you.

Some Useful Tips For Investors

The investor should consider several factors before choosing whether to invest in an MT4 PAMM account.

You need to look at these things:

- Trader’s history: In order to judge a manager’s future success, it is important to examine his or her past trading performance.

- Costs: Before investing, it is essential to be aware of every fee charged by the manager. Make sure you understand all charges associated with the account.

- The minimum deposit: Investing in a PAMM account requires a minimum investment amount, so make sure you check this before you start.

- The withdrawal terms: Also, make sure you are familiar with the withdrawal terms and conditions.

If you take the time to evaluate all of your options and requirements, you can find a PAMM account that precisely meets your objectives.

Finding the Right PAMM Account

To make sure you select the perfect PAMM account for your trading needs, take some time to research online. Several websites are available that can offer detailed information about different accounts and their features. Reading reviews from other traders will also give you an insight into what makes one PAMM account stand out more than others.

When you have identified a few prospective PAMM accounts, it would be beneficial to get in touch with their managers and inquire about their experience managing similar accounts. Additionally, ask them about any fees that come along with the account so you can easily decide whether or not this is an excellent fit for your goals.

If you’re still uncertain about which PAMM account is best for your finances, consulting with an experienced financial advisor is the way to go. A professional in this field can explain the diverse range of options accessible and assist you in making a well-educated choice regarding what plan suits your needs most accurately.

Summary

The potential for high returns and low fees makes PAMM accounts an increasingly attractive option for investors. However, before investing in an MT4 PAMM account, it is important to do your due diligence and research the manager carefully. This will help ensure that you make the best decision for you, understanding all associated risks of any investment. With careful consideration, PAMM accounts may be a great addition to your investment portfolio.